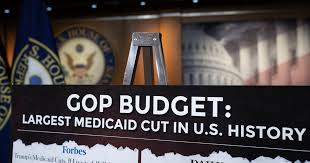

Blue Press Journal: In a move that has left many in the healthcare community reeling, President Donald Trump signed a budget bill into law on July 4 that is expected to have devastating consequences for rural hospitals across the country. The legislation, which includes significant cuts to Medicaid, is estimated to put 380 independent rural hospitals “at serious risk of closure nationwide,” according to Families USA, a non-partisan consumer health care nonprofit.

The impact of these cuts will be felt disproportionately in rural areas, where residents rely heavily on Medicaid for their healthcare needs. In an effort to mitigate the damage, GOP lawmakers included a $50 billion “Rural Health Transformation Fund” in the bill, ostensibly to support struggling rural health facilities. However, public health experts argue that this amount is woefully insufficient to offset the estimated $137 billion in losses that rural health facilities are expected to incur under the legislation.

Furthermore, the distribution methods for the $50 billion fund have been criticized as opaque and seemingly partisan. This lack of transparency has raised concerns that the funds may not be allocated in a way that effectively addresses the needs of rural hospitals and the communities they serve.

The situation is further complicated by the fact that rural hospitals will be forced to absorb the estimated 16 million uninsured patients that the Medicaid cuts are likely to create. This will put an unsustainable strain on already-overburdened healthcare systems, exacerbating existing shortages of health professionals in rural areas.

The potential consequences of these cuts are dire, with many rural hospitals facing the very real possibility of closure. This would not only deprive communities of essential healthcare services but also have a devastating impact on local economies. As the full effects of the budget bill begin to unfold, it remains to be seen whether the $50 billion Rural Health Transformation Fund will be enough to stem the tide of hospital closures and ensure that rural communities continue to have access to quality healthcare.