Blue Press Journal

November 10, 2024 — Washington, D.C.

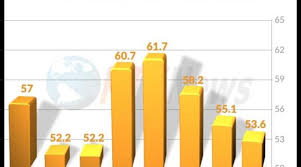

U.S. consumer confidence has dropped to its lowest level in nearly three and a half years, as the nation grapples with the longest government shutdown in American history. According to data released Friday by the University of Michigan’s Surveys of Consumers, the Consumer Sentiment Index fell sharply to 50.3 in early November, down from 53.6 in October — a clear sign that economic anxiety is spreading across households.

The shutdown, now entering its second month, has been driven by a political standoff in Congress. Republican lawmakers have refused to approve funding measures that include provisions aimed at lowering health insurance costs for American consumers. The impasse has triggered widespread disruptions across basic government services and has deepened public concern about the economic fallout.

For millions of lower-income households, the crisis is hitting home. Cuts to essential benefits, including food stamps, have left many struggling for food. Hundreds of thousands of federal employees have been furloughed without pay, while others work without wages. Transportation systems suffer from staffing shortages, causing flight delays and grounding aircraft, affecting travelers nationwide.

The economic uncertainty has been compounded by shifting inflation expectations and the Trump tariffs. The survey found that consumers now expect inflation over the next year to rise to 4.7%, up slightly from 4.6% in October. Long-term inflation expectations dipped to 3.6% from 3.9%, indicating cautious optimism about price stability in the years ahead, but little relief for immediate cost-of-living pressures.

Republican leadership and President Trump has effectively held essential services hostage, weakening the broader economy and eroding public trust in governance. Economists warn that prolonged instability could push the country toward slower growth, higher unemployment, and sustained consumer pessimism.