Elon Musk has gone beyond merely labeling the bill a “disgusting abomination”; he has made it clear that he intends to actively oppose it.

The former White House advisor has intensified his criticism of the large Republican bill that proposes significant tax cuts and Medicaid reductions, urging Americans to contact their lawmakers and oppose the legislation. While Musk’s reasons differ from those of Democrats, both sides share a common goal: to avoid increasing the national debt further. Historically, Republican presidents have contributed slightly more to the national debt per term than their Democratic counterparts, according to inflation-adjusted data from the U.S. Treasury Department and the Bureau of Labor Statistics dating back to 1913. Notably, President Trump is the largest contributor, having added an estimated $7.1 trillion to the national debt during his first term from 2016 to 2020.

This legislation is intended to represent the full scope of President Donald Trump’s domestic policy agenda for a his second term, making Musk’s strong opposition—just one week after stepping down as a senior adviser to the president—particularly noteworthy.

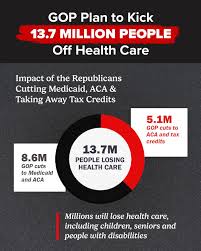

The Republican bill combines over $4 trillion in tax cuts and new spending with less than $2 trillion in cuts to Medicaid and other social programs, resulting in a net deficit increase of $2.4 trillion, according to the Congressional Budget Office. The tax cuts predominantly benefit the wealthy and corporations, which some argue are not paying their fair share.

On Wednesday, Musk posted, “A new spending bill should be drafted that doesn’t massively grow the deficit and increase the debt ceiling by 5 TRILLION DOLLARS.”

Musk is asking the public to trust someone who can land rockets vertically and develop self-driving cars more than the Republican lawmakers who passed this bill by a single vote under pressure from Trump and wealthy interests.

Now, the question remains whether the Republican-controlled Senate will stand firm or yield to Trump and his affluent allies.