President Trump’s latest 100% tariff threat against Canada will hurt American consumers, damage U.S. industries, and strain vital trade relationships. Learn why Trump’s trade war is bad economics and worse policy.

Blue Press Journal – President Donald Trump’s recent threat Satruday to impose a 100% tariff on Canadian imports has sent shockwaves through North American trade circles. The move, aimed at punishing Canada for its newly negotiated trade concessions with China, reflects the same protectionist instincts that have defined Trump’s economic agenda since his first term. But beyond the political theater, tariffs like these come with a steep price — one paid directly by American consumers, businesses, and workers.

The Canada-China Trade Context

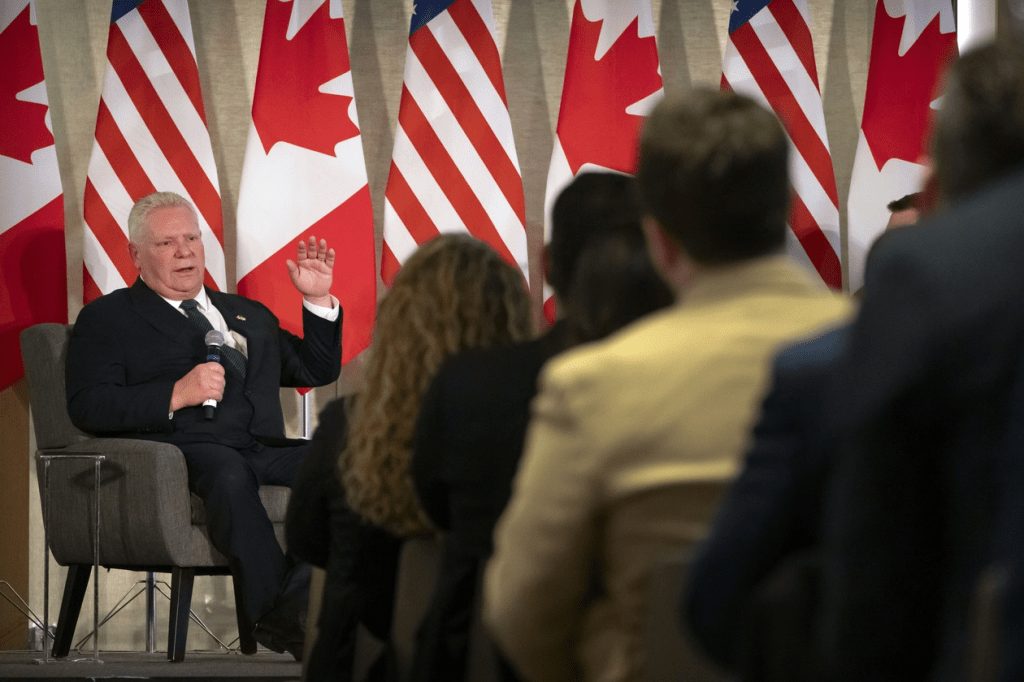

Earlier this month, Canadian Prime Minister Mark Carney announced a deal with China to lower tariffs on Chinese electric vehicles in exchange for reduced import taxes on Canadian agricultural products. While Canada maintains no free-trade agreement with China, the arrangement was crafted to support Canadian farmers and diversify trade relationships amid global tensions.

Trump initially praised the deal, but quickly reversed course, accusing Canada of becoming a “drop-off port” for Chinese goods destined for the U.S. His retaliation? Threatening a 100% import tax on Canadian goods if Ottawa proceeds — a move that would affect everything from steel to agricultural products to critical minerals.

Why Tariffs Hurt Americans More Than They Help

Tariffs are often sold to voters as a way to protect domestic industries, but the reality is that tariffs operate as a hidden tax on U.S. consumers. When the U.S. imposes tariffs, importers pay higher costs, which are then passed along to businesses and consumers in the form of higher prices.

According to a 2019 study by the Federal Reserve Bank of New York, U.S. tariffs during the Trump administration’s first trade war with China led to $1.4 billion in additional costs per month for American consumers. Similarly, research from the Peterson Institute for International Economics found that the average U.S. household paid $800 more per year due to tariff-driven price increases.

For context:

- Canada is the largest export destination for 36 U.S. states.

- Nearly $2.7 billion USD in goods and services cross the Canada-U.S. border daily.

- Canada supplies 60% of U.S. crude oil imports and 85% of U.S. electricity imports.

- It is also a key supplier of steel, aluminum, uranium, and critical minerals essential for the auto industry, defense and technology.

Imposing a 100% tariff on these imports would cause instant price spikes in energy, manufacturing, and consumer goods — directly hitting U.S. households and industries.

Economic Fallout of Trump’s Tariff Threat

If enacted, Trump’s proposed tariffs would:

- Raise Costs for Energy and Manufacturing – U.S. industries dependent on Canadian oil, electricity, and metals would face supply shortages and higher costs.

- Damage Cross-Border Supply Chains – The deeply integrated Canada-U.S. manufacturing sector, especially in automotive and aerospace, would be disrupted.

- Invite Retaliation from Canada – Ottawa could respond with its own tariffs on U.S. exports, hurting American farmers, particularly in states that rely on agricultural trade with Canada.

- Undermine NATO and Western Alliances – Trump’s antagonistic stance toward Canada, paired with his push to acquire Greenland and social media provocations, risks alienating a key ally.

Political Theater vs. Economic Reality

Trump’s rhetoric — including calling Carney “Governor Carney” and posting altered maps showing Canada as part of U.S. territory — may play well to a certain political base. But such antics undermine serious diplomatic relationships and erode trust among allies.

Carney’s speech at the World Economic Forum in Davos, urging “middle powers” to unite against coercive tactics by great powers, clearly struck a nerve with Trump. As Carney’s popularity rises on the world stage, Trump’s trade threats appear less about protecting American workers and more about retaliating against political rivals.

The Consumer’s Perspective

For the average American, tariffs mean:

- Higher grocery bills (due to increased costs on Canadian agricultural imports).

- More expensive cars and electronics (Canadian manufacturing is a key part of U.S. supply chains).

- Higher energy costs (Canadian oil, electricity, and uranium are essential to U.S. energy security).

In short: Tariffs punish consumers first, industries second, and political rivals last.

So What Does it Mean

President Trump’s threat of a 100% tariff on Canadian goods is more than a diplomatic provocation — it’s an economic self-inflicted wound. Canada is one of America’s most important trading partners, and disrupting that relationship will raise prices, strain industries, and weaken alliances.

If history is any guide, Trump’s tariffs will not force Canada to change course with China. Instead, they will drive up costs for American families, hurt U.S. competitiveness, and isolate the United States in a world where cooperation — not coercion — is the key to economic success.