Blue Press Journal: President Trump’s vision for Venezuela’s oil faces a labyrinth of geopolitical, economic, and operational challenges. We examine why extracting the country’s vast reserves may not be a boon for U.S. interests.

Trump out of step with reality

President Donald Trump’s recent assurances about U.S. oil companies seizing control of Venezuela’s underutilized oil reserves sound ambitious—and possibly out of step with reality. While Venezuela boasts the world’s largest proven oil reserves, the path to unlocking them under Trump’s plan is riddled with economic, technical, and political hurdles that even the most powerful corporations may struggle to navigate.

Venezuela’s Oil Legacy and Its Rocky Decline

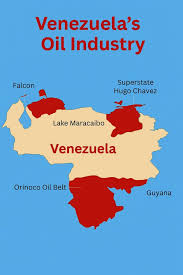

Venezuela’s oil industry was once a global powerhouse, producing over 3 million barrels per day in the late 1990s. However, the nationalization of oil infrastructure under Hugo Chávez in the mid-1990s marked the beginning of a steep decline. By 2018, production had plummeted to just 1.3 million barrels per day, according to U.S. Energy Information Administration data. Decades of mismanagement, lack of foreign investment, and U.S. sanctions have further crippled the struggling sector, which now produces less than 7% of the United States’ own output (21.7 million barrels daily in 2023).

While the reserves remain vast, the ability to extract and refine them has eroded. Infrastructure decay, from aging pipelines to dilapidated drilling rigs, has turned Venezuela’s oil fields into a patchwork of unreliable assets. Even if U.S. firms could access these reserves, they would face the monumental task of rebuilding an industry that has fallen into disrepair.

The Market Realities: A Global Oil Oversupply and Volatility

Trump’s plan assumes that increased Venezuelan oil production would benefit U.S. companies, but global market conditions tell a different story. In 2025—amid Trump’s renewed push—global oil prices dropped by 20%, the steepest decline since 2020. Analysts attribute this to an oversupplied market, with increased output from U.S. shale producers, OPEC+, and alternative energy transitions.

James Stockman, a leading energy economist, notes, “Right now the oil market’s somewhat oversupplied. That’s hurting American companies. The last thing they want is for a massive oil reserve to suddenly be opened up.” A surge in Venezuelan oil could oversaturate an already struggling market, further depressing prices and eroding profit margins for U.S. firms. At a time when energy companies are grappling with tariffs and market volatility, the prospect of pouring billions into a risky, long-term project in Venezuela is unappealing.

Operational Challenges: Heavy Oil and Infrastructure Collapse

Even if U.S. companies were willing to invest, Venezuela’s oil is not a quick win. The country’s reserves are predominantly extra-heavy crude, which requires extensive and costly upgradation to transform it into lighter, transportable oil. This process—a multi-billion-dollar undertaking—demands not only capital but also stable political and economic conditions Venezuela has not seen in decades.

Moreover, the infrastructure required to extract and process this oil is in critical disrepair. Decades of neglect have left Venezuela’s oil fields reliant on outdated equipment, while key refineries like the 520,000-barrel-per-day Amuay facility have largely fallen into obscurity. Rebuilding this infrastructure could take a decade or more, with no guarantee of returns in a market that may shift toward renewable energy by then.

Political Quagmire: Who Controls Venezuela?

The very foundation of Trump’s plan hinges on U.S. recognition of Venezuela’s new leadership, but political instability remains a wildcard. Following the contentious capture of President Nicolás Maduro, ally-turned-claimant Juan Guaidó (or another figure, as per the context) was sworn in as an interim leader. Yet, U.S. officials, including Senator Marco Rubio, have quickly backtracked, calling Guaidó’s legitimacy into question and advocating for “real elections” instead.

This inconsistency raises critical concerns for foreign investors. Venezuela’s oil contracts are often shrouded in legal ambiguity, and a lack of clear governance could deter companies wary of entanglement in a political showdown. “Legitimacy for their system of government will come about through a period of transition and real elections, which they have not had,” Rubio stated on This Week, underscoring the uncertain footing on which any U.S. oil venture would stand.

A Cautionary Tale: Why Trump’s Plan Fails the Feasibility Test

While Trump’s rhetoric echoes the 2003 Iraq invasion—where oil was a central motive—the economic landscape is worlds apart. In 2003, oil prices were rising, and technical advancements made extraction more viable. Today, declining prices, aging infrastructure, and geopolitical uncertainty form a far more complex web.

For U.S. oil companies, the risks outweigh potential rewards. The required investment would run into tens of billions, with returns stretching over decades in a market that may not justify the expenditure. Additionally, the environmental and moral implications of reviving a resource-extraction economy in a country ravaged by sanctions and authoritarianism could invite corporate reputational damage.

President Trump’s grand vision for Venezuela’s oil is less about economics and more of a political stunt. The harsh truth of a stagnant market, decaying infrastructure, and erratic leadership proves that tapping into Venezuela’s immense reserves will likely remain an elusive fantasy for U.S. companies. Forget quick profits; the real blow may come in the form of wasted investments. The takeaway for investors is stark: even the richest resources can’t be unleashed merely through lofty ambitions—they require the right timing, genuine stability, and a market primed for opportunity.

Leave a comment